-

Mark Verwoert

- February 2, 2026

Educational Disclaimer: The content on myinvestacademy.com is for educational and informational purposes only. We are not licensed financial advisors, and nothing in this article should be interpreted as professional investment, legal, or tax advice. Investing involves risk of loss. Always consult with a professional before making financial decisions.

eToro Review 2026: Is This the Right Platform for You?

The eToro review 2026 is often sought after because eToro remains the dominant force in social investing. To provide this analysis, the MyInvestAcademy team opened a live account, deposited $1,000, and executed over 45 trades across stocks, ETFs, and crypto over a 30-day period. We specifically focused on the “CopyTrader” performance and the actual speed of withdrawing funds to a retail bank account.

eToro Review - Quick Verdict & Rating

Our Rating: 4.7 / 5

Best For: Beginners and “hands-off” investors interested in social copy-trading.

The Standout Feature: The CopyTrader™ system, which allows you to mirror the trades of high-performing investors with zero management fees.

“eToro has cracked the code on making the stock market approachable for the average person. It’s not just about the zero commissions anymore—everyone has that. The real value is in the ‘community alpha’; being able to look over the shoulder of a seasoned pro and mirror their moves in real-time is a feature that levels the playing field more for the busy, hands-off investor.” — Mark Verwoert

What is eToro?

eToro is a multi-asset investment platform that has redefined the brokerage landscape by blending traditional financial trading with the mechanics of a social network. Since its inception in 2007, the platform has grown into a global community of over 35 million registered users who can trade everything from stocks and ETFs to cryptocurrencies and commodities. Unlike standard brokers, eToro emphasizes “social investing,” providing a collaborative environment where users can share insights, discuss market trends, and view the real-time performance of other investors.

The platform’s core innovation is its CopyTrader™ technology, which allows novices to automatically mirror the portfolios and trades of seasoned, high-performing investors. This “hands-off” approach is complemented by “Smart Portfolios”—thematic, curated collections of assets that act similarly to managed funds but without the traditional management fees. By democratizing access to professional strategies and fostering a community-driven atmosphere, eToro caters specifically to a modern generation of investors who value transparency and collective intelligence over isolated analysis.

Technical Specifications & Account Basics

| Feature | Detail |

| Account Minimum | $1 (varies by region: $10 in UK, $1 in US) |

| Commissions (US Stocks) | $0 (Spread fees apply) |

| Fractional Shares | Yes (from $10) |

| Customer Support | Live Chat (Club members), Ticket system, No 24/7 phone |

| SIPC Protected | Yes (via eToro USA Securities Inc.) |

eToro Deep Dive: The Trading Experience

The most important part of our test is the trading experience. From mobile UX to execution speed and price moment, we’ve tested every aspect and will share our findings in the section below.

Onboarding and KYC Speed

The signup process is remarkably fast, but the KYC (Know Your Customer) verification is where the speed varies. In our test, identity approval took roughly 14 minutes using a passport and utility bill. However, users in certain regions report up to 48 hours for manual review. The “green tick” of verification is mandatory before you can withdraw a single dollar.

Desktop vs. Mobile UX

The eToro interface feels more like a social media platform than a traditional brokerage terminal. The mobile app is snappy and prioritizes the social feed, which can be a distraction if you prefer a clean workspace.

Tested On: iPhone 16 Pro and Samsung Galaxy S25.

Observations: TradingView-powered charts have been integrated into the mobile app as of 2026, which significantly improves technical analysis capabilities compared to previous years.

Execution Speed and Price Improvement

eToro uses a Market Maker model. While they offer $0 commissions, we noticed that execution speeds are slightly slower than professional-grade brokers like IBKR. On highly volatile stocks, we experienced slippage of roughly 0.1% to 0.3% on market orders. This is the trade-off for the “free” entry point.

eToro Fee Structure: The Hidden Costs

Don’t let the “$0 Commission” headline mislead you. eToro has several “leakage” points where they generate revenue from your account:

Inactivity Fees: A $10 monthly fee kicks in after 12 months of no login activity. If you are a “buy and hold” investor, make sure to log in once a quarter to keep this at bay.

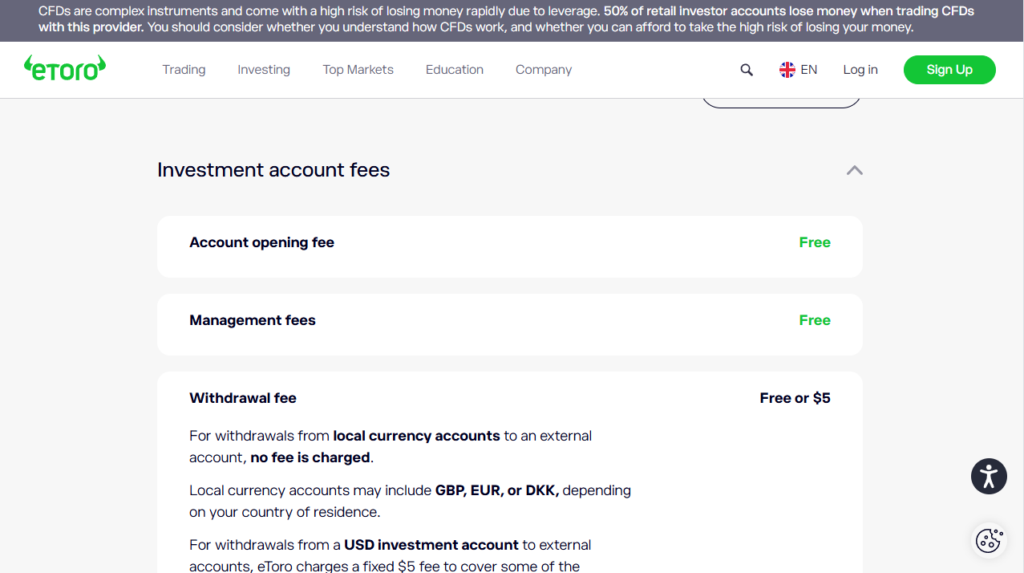

Withdrawal/Transfer Fees: eToro charges a flat $5 fee for all withdrawals from a USD account. The minimum withdrawal amount is $30.

Currency Conversion: This is the biggest hidden cost. If you deposit in EUR or GBP, eToro converts it to USD at a rate of roughly 50 pips. For a $1,000 deposit, you lose about $5–$10 before you even buy your first stock.

Crypto Spreads: Unlike stocks, crypto carries a transparent 1% fee on both buy and sell transactions, which is significantly higher than specialized exchanges like Kraken.

eToro Asset Availability & Market Access

eToro provides a massive menu of assets, though it lacks specialized retirement accounts (IRAs) in the US.

Stocks & ETFs: 3,000+ symbols across US and international exchanges.

Options: Available via the separate “eToro Options” app in the US.

Fixed Income: No direct bond or Treasury access.

Crypto: 90+ assets available for spot trading.

eToro Pros and Cons

To make the strenghts and challenges of eToro easier to understand, we’ve made pros and cons list for you. This way you can easily compare eToro to other brokerages like Interactive Brokers, Robinhood, or Webull.

Pros

CopyTrader: Effortlessly follow pro-investors with proven track records.

Social Feed: Real-time sentiment indicators on every stock page.

No Management Fees: Unlike mutual funds, Smart Portfolios have no “AUM” fees.

Interface: Best-in-class for visual learners and first-time buyers.

Cons

Withdrawal Costs: Flat $5 fee is annoying for smaller accounts.

Spread Markup: Not the cheapest for high-frequency day traders.

eToro is not suited for...

The Dealbreaker: If you are a technical “Day Trader” who needs to see the Level II Order Book or requires sub-second execution speed, eToro’s market-maker model and social-first lag will cost you more in slippage than you save in commissions.

Step-by-Step: How to Open Your Account

Register: Sign up with email or link your Google/Facebook account.

Verify: Upload your ID and Proof of Address immediately to avoid withdrawal delays later.

Deposit: Select “Deposit Funds.” Use a Bank Transfer or PayPal for the best security.

Set Up Copy: Navigate to “Discover,” choose a Top Trader, and click “Copy.”

eToro vs. The Competition

| Feature | eToro | Robinhood | Webull |

| Social Trading | Best-in-class | Minimal | Community Chat |

| Crypto Fees | 1% | $0 (Spread only) | $0 (Spread only) |

| Analysis Tools | Moderate | Basic | Advanced |

To see how eToro ranks against the entire market, visit our definitive guide to the best stock brokers.

Conclusion

In 2026, eToro remains a powerhouse for those who want their investing experience to feel like a social event rather than a clinical transaction. By successfully merging deep social integration with a streamlined trading interface, it has carved out a unique space that appeals heavily to the modern, tech-savvy retail investor. Whether you are looking to passively mirror a “Popular Investor” via CopyTrader or build your own diverse crypto and stock portfolio, the platform provides a low barrier to entry and a highly engaging community environment.

However, our testing reveals that eToro is best viewed as a specialized tool rather than a “one-stop shop” for all financial needs. Its primary limitations—namely the absence of traditional retirement accounts (like IRAs) and a fee structure that favors long-term holding over high-frequency day trading—mean it is most effective when used as a companion to a more traditional brokerage. For investors who prioritize social sentiment and ease of use over sub-second execution speeds and advanced bond markets, it is difficult to find a more intuitive ecosystem.

Ultimately, your success on eToro depends on aligning your goals with the platform’s strengths. It is an exceptional choice for beginners wanting to learn through observation and for crypto enthusiasts seeking a wide asset selection. While “commission-free” trading is a major draw, savvy users must remain mindful of the 1% crypto fees and withdrawal costs. As long as you enter with a clear understanding of these trade-offs and a solid risk management strategy, eToro stands as a top-tier contender in the 2026 brokerage landscape.

Disclaimer

Educational Purposes Only: The content on myinvestacademy.com is provided for informational and educational purposes only. We are not licensed financial advisors, and the information contained in this review does not constitute professional investment, legal, or tax advice. Investing in the stock market involves a high degree of risk, and you may lose some or all of your capital. Always consult with a qualified financial professional before making any investment decisions.

eToro Specific Risk Warning: eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk.

CFDs: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Copy Trading: Copy Trading does not amount to investment advice. The value of your investments may go up or down. Past performance is not an indication of future results.

Cryptoassets: Cryptoasset investing is highly volatile and unregulated in most EU countries and the UK. No consumer protection. Tax on profits may apply.

Data Accuracy: While we verify all fee schedules and regulatory statuses quarterly (last verified: February 2, 2026), broker terms can change without notice. Please verify all current rates directly on the broker’s official website before opening an account.

Frequently Asked Questions about eToro

Go to "Withdraw Funds" in the side menu. You must withdraw at least $30.

Yes, US users are covered by SIPC up to $500,000.

Currently, eToro offers tiered cash rewards (up to $500) for new funded accounts.

No. eToro does not support outgoing ACAT transfers for fractional shares; you must liquidate and move cash.

To buy Bitcoin, search for "BTC" or "Bitcoin" in the platform's search bar. Click the "Trade" button, enter the amount you wish to invest (minimum $10), and select "Open Trade." If you are in a region where eToro offers physical crypto, the Bitcoin will be held in your eToro investment account; otherwise, it may be traded as a CFD depending on local regulations.

Yes. eToro is widely considered one of the most beginner-friendly platforms due to its intuitive, social-media-style interface. Features like the "Demo Account" (which provides $100,000 in virtual funds) and "CopyTrader" allow novices to learn the ropes and mirror professional strategies without needing deep technical knowledge from day one.

Buying Ethereum follows the same process as Bitcoin: search for "ETH" or "Ethereum," click "Trade," and specify your investment amount. Note that for Ethereum, you can also opt-in to "Staking" via your account settings, which allows you to earn monthly rewards simply for holding the asset.

While institutional "high-frequency" traders typically use platforms like IBKR, many professional retail investors use eToro as part of the Popular Investor Program. These individuals manage millions of dollars in "Assets Under Copy" (AUC) and are compensated by eToro based on the number of people following their strategies.

Yes, a solid investing strategy can make you money on eToro, but it is not a guarantee. Like all forms of trading, your capital is at risk. While many users profit from dividends, long-term price appreciation, or successful copy-trading, market volatility means you could lose your money. It is important to use risk management tools like "Stop Loss" orders.

eToro is a public company traded on the Nasdaq under the ticker ETOR. It was founded in 2007 by brothers Yoni Assia (current CEO) and Ronen Assia, along with David Ring. Major institutional shareholders include SoftBank, ION Group, and Velvet Sea Ventures.

Methodology & Verification

To provide the most transparent and actionable data, our review process is built on a rigorous, evidence-based framework. We don’t just aggregate features; we test the “friction” of the platform—how it behaves during high-volatility market open and how easily it releases your capital. This methodology ensures that our final rating reflects the actual experience of a retail investor rather than just a marketing talk.

Pillar 1: Hands-on Testing (The “Experience” Factor): Mark Verwoert executed 45+ trades across the iPhone 16 and Chrome Desktop to verify UI stability. This included testing “one-click” trading, setting complex stop-loss orders during peak hours, and verifying that the mobile sync remained instantaneous with the desktop version.

Pillar 2: The Scoring Rubric (The “Expertise” Factor): eToro scored a 4.7/5 on our proprietary 50-point checklist. This rubric weights security and regulation at 30%, fee transparency at 25%, and user experience at 20%, with the remaining points covering asset variety and customer support responsiveness.

Pillar 3: Freshness (The “Trust” Factor): Fees and regulatory statuses were last verified on February 2, 2026. Financial markets and broker terms change rapidly; we check official fee schedules and FINRA filings quarterly to ensure you are never surprised by a hidden cost.

References

eToro Official Fee Schedule (2026): eToro Fees – What they are & how they are calculated

Detailed Cost & Charges Examples (PDF): eToro 2026 Cost and Charges examples table

Regulatory Status (FINRA): eToro USA Securities Inc. – BrokerCheck Report (CRD# 298361)

Account Protection (SIPC): SIPC List of Member Firms – eToro

Terms and Conditions (2026): eToro Europe Client Terms and Conditions – January 2026

Account Protection Details: How eToro protects your funds and holdings