Is Dino Polska Europe's Best Growth Stock?

While the headlines in Western Europe and the US are dominated by tech AI rallies, a quieter, more consistent compounding machine has been operating in Central Europe. Dino Polska (WSE: DNP), the Polish mid-sized supermarket chain, has faced significant volatility over the last six months. However, with the release of the Q3 2025 data (we are still waiting for the Q4 report of 2025) and a valuation that has compressed significantly from its historical highs, investors are asking: is the growth story over, or is this the buying opportunity of the decade?

Disclaimer: This article is for educational and informational purposes only and does not constitute financial, investment, or professional advice. Always perform your own due diligence before making any financial decisions.

What is Dino Polska?

Dino Polska is one of Poland’s fastest-growing retail networks, founded in 1999 by Tomasz Biernacki. Unlike traditional hypermarkets that rely on massive square footage in city centers, Dino operates on a unique “proximity” model. They focus on small-to-medium-sized towns and the outskirts of large cities, placing standardized stores exactly where people live.

Their strategy is essentially a real-estate play combined with retail. Dino owns the vast majority of the land and buildings where their stores operate, insulating them from rising lease costs and allowing for rapid, standardized construction. They function primarily as a grocery store with a heavy emphasis on fresh meat (owning their own meat processing plant, Agro-Rydzyna), which drives recurring foot traffic.

Supermarket Stocks Either Win or Flop

Grocery retail is a notoriously difficult business. Margins are razor-thin, competition is fierce, and operational inefficiency is punished without mercy. Generally, grocery stocks fall into one of two categories: the compounding winners or the debt-laden flops.

Winner: Walmart (WMT)

Walmart is the archetype of a winner. By relentlessly leveraging economies of scale, investing in logistics, and putting pressure on suppliers, they created a “moat” based on price. They used their cash flow to innovate (e-commerce) and return capital to shareholders. The result is a stock that has steadily marched upward for decades.

Flop: Casino Guichard-Perrachon (CO)

On the other side of the Atlantic, the French retailer Casino serves as a cautionary tale. Unlike Dino or Walmart, Casino relied heavily on complex financial engineering and massive debt to fund expansion. When inflation spiked and consumer habits changed, their debt burden became unsustainable, leading to massive restructuring and a near-total wipeout of shareholder value.

The Difference

The difference lies in capital allocation. Supermarkets work on volume. If a company can maintain high Return on Invested Capital (ROIC) while expanding (like Walmart), they win. If they borrow to fuel low-return growth (like Casino), they eventually collapse under their own weight.

Dino Polska Fundamental Overview

Looking at the current financial snapshot of Dino Polska, the company clearly sits in the “Winner” camp, though the valuation requires a closer look.

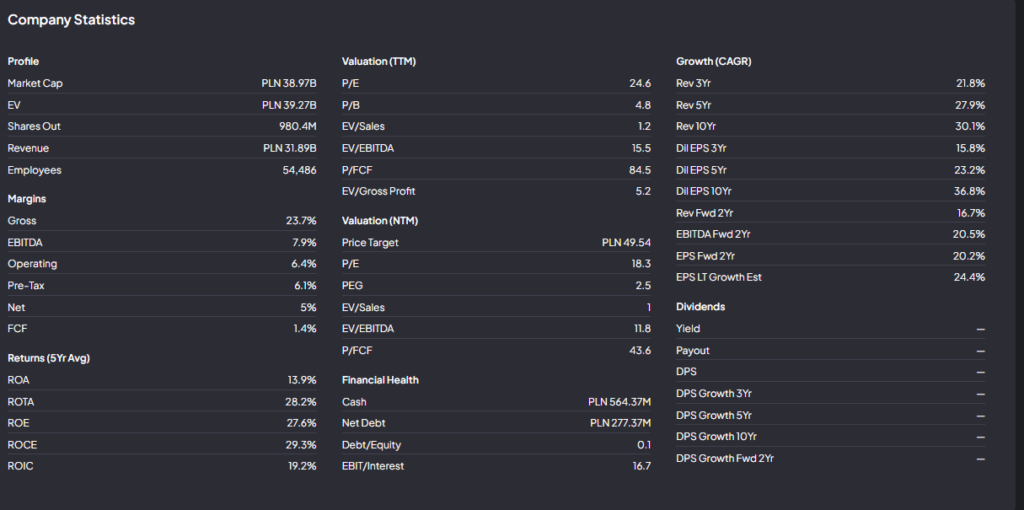

Based on the latest data:

Growth is slowing but remains impressive: The company boasts a 10-Year Revenue CAGR of 30.1% and a 10-Year Diluted EPS CAGR of 36.8%. While the 3-year revenue growth has cooled slightly to 21.8%, these are still growth numbers that most tech companies would envy, let alone a grocer.

Elite Efficiency: The most critical metric for a retailer is how well they use their cash. Dino currently posts a Return on Invested Capital (ROIC) of 19.2% and a Return on Equity (ROE) of 27.6%. This confirms that for every Złoty invested in a new store, Dino is generating best-in-class returns.

Fortress Balance Sheet: In stark contrast to the “Flop” examples in retail, Dino operates with a Debt/Equity ratio of just 0.1. With PLN 564.37M in Cash and Net Debt at a manageable PLN 277.37M, they are self-funding their expansion.

Valuation Compression: The stock is currently trading at a P/E (TTM) of 24.6. More interestingly, the Forward P/E is 18.3, suggesting analysts expect a significant earnings jump in the next twelve months. A PEG ratio of 2.5 suggests it isn’t “cheap” in the traditional value investing sense, but for a company growing EPS at over 20%, it is becoming attractive.

Margins: Gross margins are holding steady at 23.7%, with a Net Margin of 5%. Maintaining a 5% net margin in the grocery sector is a testament to their operational discipline.

Management Outlook

In the most recent Q3 2025 report, the Management Board addressed the slowing pace of inflation and its impact on basket sizes. They highlighted their commitment to the long-term strategy despite short-term macro headwinds.

According to the Q3 2025 report:

“In the face of stabilizing food inflation, our focus remains strictly on volume growth and traffic generation. We have continued to densify our network in western Poland while aggressively acquiring land in the eastern regions to secure our pipeline for 2026 and 2027.”

Furthermore, addressing the operational costs, management noted:

“investments in photovoltaic installations on market roofs have begun to materially offset rising energy costs, contributing to the protection of our EBITDA margin.”

Is Dino Polska a Buy After Recent Sell Off?

Dino Polska has transitioned from a hyper-growth small cap to a mature European compounder. The recent sell-off reflects the market’s fear that the “easy growth” phase is over. However, the fundamentals tell a different story.

With a Forward P/E of 18.3 and an ROIC of nearly 20%, Dino offers a rare combination of safety and growth. They are not burdened by debt, they own their real estate, and they have significant white space left to conquer in Eastern Poland.

For investors willing to look past the short-term noise, Dino Polska remains one of the highest-quality businesses in Europe. The current price offers a much safer entry point than the highs of previous years, making it a “Buy” for those with a long-term horizon.

Disclaimer: This article is for educational and informational purposes only and does not constitute financial, investment, or professional advice. Always perform your own due diligence before making any financial decisions.

References

Dino Polska Investor Relations: https://grupadino.pl/en/investor-relations/

Warsaw Stock Exchange (GPW) – Dino Profile: https://www.gpw.pl/company-factsheet?isin=PLDINOP00015