Magnum Ice Cream Company Full Year Results 2025

Magnum Ice Cream Company delivered a solid operational performance in 2025, navigating significant currency headwinds and the complexities of its recent demerger. As a newly standalone entity, the company has focused on a strategy of innovation and capital investment to drive future growth in a resilient global market.

Is Magnum Ice Cream Company ready to melt the competition, or will FX headwinds freeze its momentum? Let’s dive into the full-year results.

Disclaimer: This article is for educational and informational purposes only and does not constitute financial, investment, or professional advice. Always perform your own due diligence before making any financial decisions.

What is Magnum Ice Cream Company?

Magnum Ice Cream Company, known for its premium portfolio including the iconic Magnum brand, operates as a global leader in the ice cream sector. Following its separation, the company has been executing a focused and integrated strategy designed to provide a strong foundation to unlock value.

With a “Perfect Portfolio” approach and a revitalization of its Kids segment, the company aims to capitalize on its brand strength across Europe, ANZ, AMEA, and the Americas.

Key Performance Indicators

| Metric | Insight |

| Global Market Growth | 3.7% in 2025, in line with the last 10-year average, demonstrating market resilience. |

| Operational Performance | Solid delivery despite significant foreign exchange (FX) headwinds. |

| Adjusted EBITDA Margin | Impacted by FX, commodity inflation, and D&A (Depreciation & Amortization). |

| Free Cash Flow | Impacted by demerger costs and TSA (Transitional Service Agreement) impacts. |

| Capital Expenditure | Step-up in CapEx focused on driving growth and productivity. |

MICC Financial Performance FY 2025

The fiscal year 2025 was characterized by “solid operational performance” despite external challenges. The company faced significant headwinds from foreign exchange rates, which, combined with commodity inflation and Depreciation & Amortization (D&A), put pressure on Adjusted EBITDA margins.

Segment Performance

The results were broken down across key geographies, reflecting the company’s global footprint:

Europe & ANZ

AMEA (Asia, Middle East, Africa)

Americas

While specific regional figures were not detailed in the summary, the explicit segmentation highlights the importance of a tailored approach to these diverse markets.

Cash Flow & Unilever Demerger Impact

Free Cash Flow for the year was notably impacted by the demerger process and the associated Transitional Service Agreement (TSA) costs. These are typical one-off hurdles for a newly independent company establishing its own operational infrastructure.

Operational Highlights: Innovation & Strategy

Magnum Ice Cream Company is not standing still. The 2025 results emphasize a growth strategy powered by innovation and strong brands.

Innovation Growth Program: A dedicated program is in place to drive product development and market expansion.

Channel Execution: The company is focused on winning in channels where the consumption mix is shifting, ensuring availability where consumers want it most.

Portfolio Revitalization: A specific highlight for 2025 was the “Perfect Portfolio” initiative, with a focus on revitalizing the Kids ice cream segment.

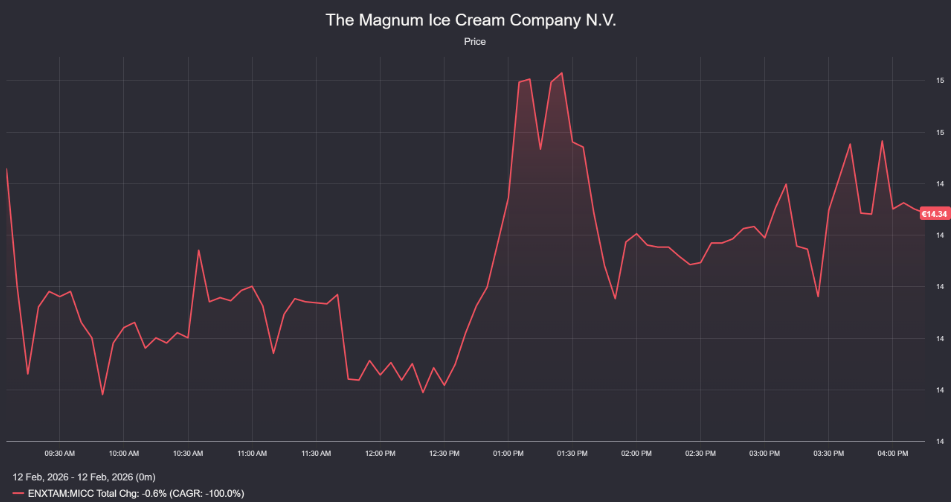

Market Reaction: -12% Price Correction

Despite management’s emphasis on “solid operational performance,” the market’s reaction to the full-year results was notably frosty. Following the release, the stock price experienced a sharp correction, dropping -12%.

Investors appear to be reacting negatively to the complexity of the financial picture. While top-line growth and market resilience are positives, the combination of significant FX headwinds, commodity inflation, and the heavy costs associated with the demerger (TSA impacts) likely spooked the market. The repricing suggests that Wall Street may be taking a “wait and see” approach, looking for clearer signs that margins will stabilize and that the expensive work of becoming a standalone entity is nearing completion.

Magnum Ice Cream Company Outlook 2026

Looking ahead, the company has laid out its outlook for FY 2026. The strategy involves a continued step-up in capital expenditure, specifically targeted at driving further growth and enhancing productivity.

The global ice cream market remains a “large, growing and resilient” sector, having posted another year of solid growth at 3.7% in 2025. Magnum Ice Cream Company aims to leverage this market stability to expand its leadership.

Conclusion

Magnum Ice Cream Company’s first full year results for 2025 paint a picture of a business building a robust foundation. While FX and demerger-related costs after MICC’s IPO have weighed on margins and cash flow, the underlying market growth and the company’s aggressive investment in innovation and capital expenditure suggest a clear focus on long-term value creation.

However, the -12% market correction serves as a stark reminder that investors are demanding clean execution. For 2026, the key will be translating that “solid operational performance” into improved bottom-line results and moving past the friction of the demerger.