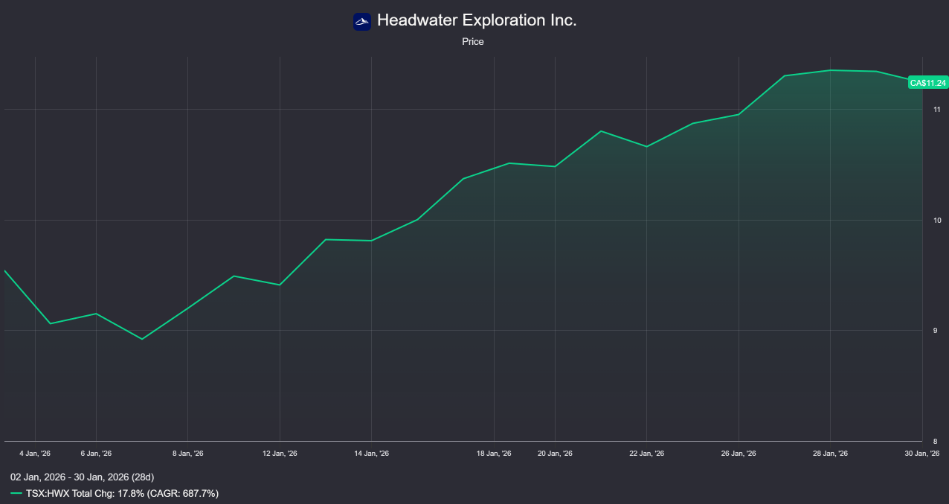

Headwater Exploration Inc (HWX) Up 18% YTD

Headwater Exploration (TSX: HWX) is making it look easy. While the broader energy sector has seen its fair share of volatility to start 2026, Headwater has taken the “up and to the right” approach, surging 18% YTD in just the first month of the year.

For investors in Headwater Exploration, this isn’t just a lucky streak—it’s the result of a clinical execution in the Clearwater play that has the market finally rerating this mid-cap producer.

Disclaimer: This article is for educational and informational purposes only and does not constitute financial, investment, or professional advice. Always perform your own due diligence before making any financial decisions.

What is Headwater Exploration Inc. (HWX)?

Headwater Exploration is a Canadian oil and gas producer that has become the “poster child” for capital efficiency on the TSX. Unlike legacy producers bogged down by massive debt or aging assets, Headwater was built from the ground up to dominate a specific geography: the Clearwater formation in Alberta.

Led by a management team with a history of massive exits (notably the Raging River team), HWX operates with a clean balance sheet—meaning zero debt—and a laser focus on high-margin heavy oil. They aren’t trying to be everything to everyone; they are simply trying to be the most profitable player in Canada’s hottest oil play.

The Clearwater Play: Massive Cashflow to be Expected

The Clearwater formation is often called the “most economic play in North America,” and for good reason. The wells are relatively shallow, making them cheap to drill, yet they produce high-quality heavy oil with impressive initial flow rates.

However, the real story for 2026 isn’t just about drilling new wells; it’s about Secondary Recovery.

The "Waterflood" Advantage

Headwater is aggressively implementing waterflooding and polymer flooding across its Marten Hills acreage.

Decline Mitigation: By injecting water or polymers into the reservoir, they are pushing more oil to the surface and slowing the natural decline of their wells.

Asset Duration: This tech-heavy approach is expected to reduce corporate decline rates to under 20% by the end of 2026.

Low Reinvestment: Because the wells last longer, Headwater only needs to reinvest about 30–35% of its cash flow to maintain production.

Headwater Exploration in Numbers

| 2026 Guidance Metric | Projected Value |

| Annual Production | 24,500 boe/d (+8% YoY) |

| Capital Expenditures | $185 Million |

| Adjusted Funds Flow | ~$300 Million (at $60 WTI) |

| Dividend Yield | ~4.0% – 5.0% (at current prices) |

How much of the potential growth is locked in the current share price of $HWX?

With the stock sitting at $11.30 (up from ~$9.60 on Jan 1st), the big question is whether you’re late to the party.

The Valuation Split

The market is currently wrestling with two different ways to value HWX:

The P/E Perspective (Priced In): At a P/E ratio of roughly 15.6x, Headwater is trading in line with its industry peers. From a purely “earnings” standpoint, the 18% jump has captured most of the near-term upside.

The DCF Perspective (Hidden Upside): If you look at the Discounted Cash Flow (DCF) models, some analysts suggest an intrinsic value closer to $22.00. This assumes the secondary recovery success continues to expand the company’s reserve life index (which grew by over 50% in 2025).

The Verdict: Much of the “low-hanging fruit” growth from initial drilling is priced in. However, the market has yet to fully value the multi-decade sustainability of their secondary recovery pools

Conclusion

Headwater Exploration’s 18% YTD run is a victory lap for a company that has consistently hit its production targets while keeping its hands out of the debt markets. With 60% of their production slated to be supported by secondary recovery by year-end, the company is transitioning from a “growth-at-all-costs” explorer to a “sustainable-cash-flow” titan.

For the disciplined investor, $HWX represents a rare combination of a healthy dividend yield and a management team that actually knows how to protect the downside.

References

- Headwater Exploration Inc. financial reports – (Headwater Exploration)

- Financial information $HWX – (Yahoo Finance)