Is $META the New $GOOGL Stock Opportunity?

Investors who missed Alphabet’s remarkable AI-driven resurgence are now asking whether Meta presents a similar opportunity. Both tech giants faced existential threats that Wall Street initially viewed with skepticism, only to see their stock prices surge as they demonstrated AI leadership. As Alphabet stock (GOOGL) has proven doubters wrong with its AI integration and search dominance, many analysts believe Meta stock (META) could follow a comparable trajectory, potentially offering outsized returns for investors willing to bet on Meta’s transformation.

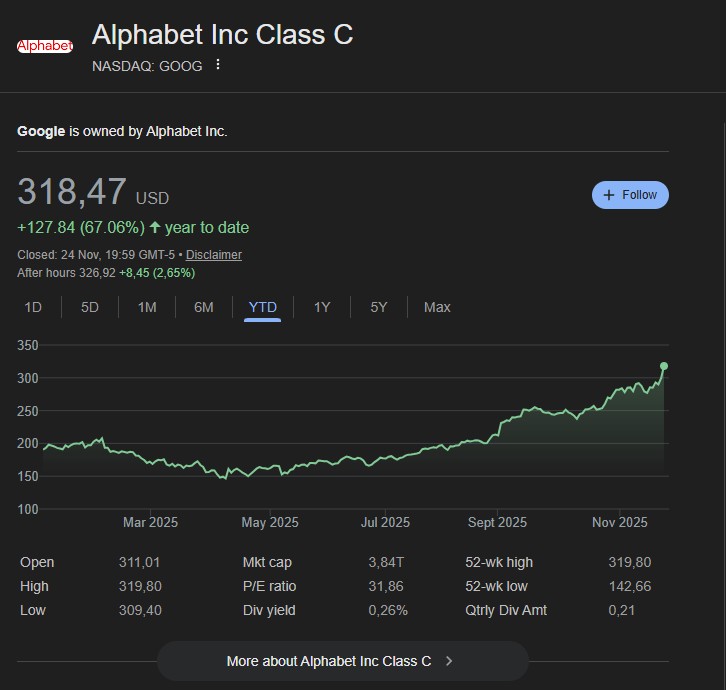

The Stock Growth of $GOOGL

Alphabet stock underwent a dramatic sentiment shift throughout 2023 and 2024, transforming from an AI victim narrative to an AI powerhouse story. Initially, investors feared that ChatGPT and generative AI would destroy Google’s search monopoly and advertising business model. The stock traded at depressed valuations as concerns mounted about losing market share to AI-powered alternatives. However, Alphabet methodically demonstrated its AI capabilities through Gemini, its large language model, and successfully integrated AI features directly into Search, Gmail, and Google Workspace without cannibalizing its core revenue streams.

The turning point came as Wall Street recognized that Google’s massive data advantages, computing infrastructure, and distribution channels made it uniquely positioned to monetize AI rather than be disrupted by it. Alphabet’s ability to maintain search dominance while layering AI capabilities on top proved the business model was more resilient than feared. The company’s cloud division also emerged as a major AI beneficiary, with Google Cloud’s growth accelerating as enterprises sought AI infrastructure. This fundamental reassessment, combined with strong earnings execution and margin expansion, sent $GOOGL soaring and rewarded patient investors who saw through the initial panic.

Our Bull Case for $META to Outperform the S&P500

Meta stands at a similar inflection point as $GOOGL did 18 months ago, with the market underestimating its AI-driven transformation potential. Here’s why Meta stock could deliver market-beating returns over the next three years:

- AI-Powered Advertising Efficiency: Meta’s AI recommendation algorithms are dramatically improving ad targeting and conversion rates, allowing advertisers to achieve better ROI and justifying higher ad spending on the platform

- Reality Labs Optionality: While currently unprofitable, Meta’s $10+ billion annual investment in VR/AR creates a valuable call option on the next computing platform, similar to how cloud investments eventually paid off for Amazon

- User Engagement Resilience: Despite competition from TikTok, Meta’s family of apps (Facebook, Instagram, WhatsApp) maintains 3+ billion daily active users with increasing time spent, particularly as AI-driven content recommendations improve

- Operating Leverage Opportunity: After the 2023 “Year of Efficiency,” Meta has demonstrated ability to grow revenue while controlling costs, with significant margin expansion potential as the top line accelerates

- Undervaluation Relative to Peers: Trading at a lower forward P/E multiple than other Magnificent 7 stocks despite comparable growth prospects and higher profitability than several peers

- WhatsApp and Threads Monetization: Two largely unmonetized platforms with massive user bases represent significant revenue upside that isn’t fully reflected in current valuations

However, Meta must navigate substantial challenges to realize this bull case. Regulatory pressures across the US and EU threaten the company’s data collection practices and advertising model, with potential fines and operational restrictions that could hamper growth. The metaverse bet remains highly speculative with no clear path to profitability, and continued Reality Labs losses could eventually test investor patience. Competition for user attention intensifies daily, particularly from TikTok and emerging AI-native social platforms. Additionally, any meaningful deterioration in the digital advertising market during an economic downturn would disproportionately impact Meta’s concentrated revenue model. Successfully threading these needles while executing on AI innovation will determine whether Meta delivers $GOOGL-style returns or disappoints investors.

Learn more about investing

Looking for more stock news, thorough analysis, or guides to show you the exact strategies used by professional investors? Make sure to check our stock investing guide 2026.