Is Microsoft a Buy? A Value Investing Perspective on the 2026 Pullback

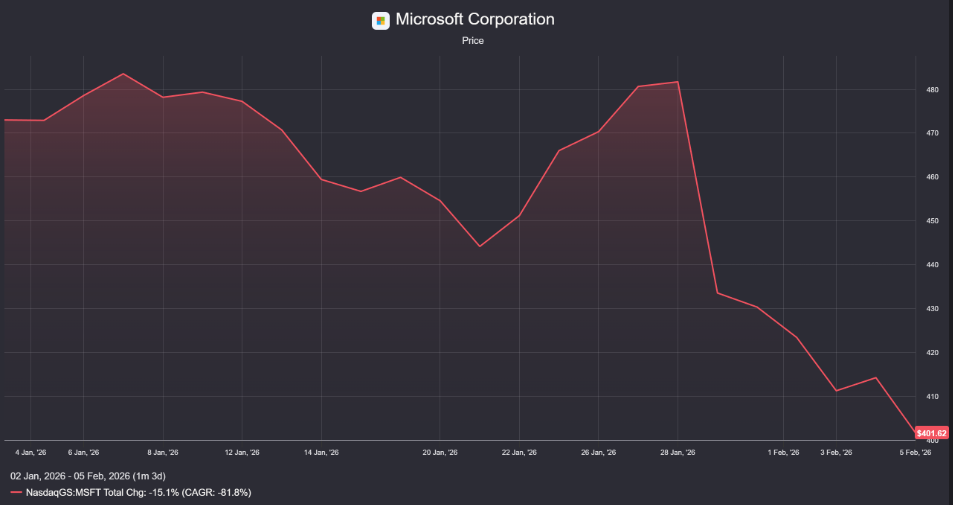

Microsoft (NASDAQ: MSFT) has long been the cornerstone of defensive growth portfolios, but 2026 has started with a shock to the system. With the stock down significantly year-to-date, investors are asking a critical question: Is the thesis broken, or is Mr. Market offering us a rare discount on a high-quality compounder?

Disclaimer: This article is for educational and informational purposes only and does not constitute financial, investment, or professional advice. Always perform your own due diligence before making any financial decisions.

Why is Microsoft Down YTD? The "Capex Indigestion" Explained

Microsoft’s stock has struggled in early 2026, currently trading roughly 14-15% below its recent highs. For a company of this quality, a double-digit drawdown is a significant event that warrants a deep dive.

The primary driver of this decline is not a lack of demand, but rather a costly bottleneck. The market’s reaction to the fiscal Q2 2026 earnings report was swift and punishing. While Microsoft delivered strong headline numbers – revenue up 17% to $81.3 billion –investors fixated on two concerning trends:

Massive AI Capital Expenditures: Microsoft spent a staggering $37.5 billion in capital expenditures (Capex) in just one quarter. To put that in perspective, that is more than the entire annual GDP of some small nations. Value investors are rightly wary of “growth at any cost,” and Wall Street is currently suffering from sticker shock. There is growing anxiety that the return on investment (ROI) for this infrastructure build-out will take longer to materialize than previously hoped.

Capacity Constraints Limiting Growth: Ironically, Microsoft cannot build data centers fast enough. The company admitted that Azure growth (which came in at 39%) would have been even higher if they had enough AI capacity to meet demand. For the first time, Microsoft is visibly supply-constrained, forcing them to throttle growth while simultaneously spending record amounts of cash.

What this means for investors: The short-term narrative has shifted from “limitless AI growth” to “margin compression and execution risk.” However, from a value perspective, this is often where opportunity lies. The demand signal is flashing green; the company simply needs time to build the pipes.

Fair Value Estimate: Is There a Margin of Safety?

Despite the bearish sentiment, the intrinsic value of Microsoft remains robust. The company continues to print cash and holds a massive backlog of business, with commercial remaining performance obligations (RPO) swelling to $625 billion.

Based on a Discounted Cash Flow (DCF) analysis that normalizes the current Capex cycle and projects a return to margin expansion in FY2027, we see the stock as undervalued at current levels.

MyInvestAcademy Fair Value Estimate: $550 – $600

Current Trading Range: ~$400

Implied Upside: ~35% – 50%

We align with the assessment from Morningstar, which maintained a $600 fair value estimate following the Q2 earnings release. The current price offers a respectable “margin of safety” for long-term investors willing to look past the 2026 “investment year” volatility.

Microsoft (MSFT) vs. Google (GOOGL): The AI Heavyweights Compared

When allocating capital in big tech, the comparison often narrows to Microsoft versus Google (Alphabet). While Microsoft has historically owned the corporate office, the gap is narrowing. Google is no longer just a consumer advertising giant; it has become a formidable enterprise competitor, currently trading at what many consider fair value relative to its growth prospects.

Comparison Analysis

Microsoft’s Position: Microsoft commands a “quality premium.” Its moat is built on deep institutional entrenchment—from Windows to Azure to 365. The switching costs are incredibly high, providing investors with a degree of safety and predictability that few companies can match.

Google’s Momentum: Google is successfully shedding its “consumer-only” perception. Google Cloud Platform (GCP) is gaining significant ground in the enterprise sector, winning major multi-cloud mandates and challenging Azure’s dominance. With Gemini for Workspace now directly competing with Microsoft Copilot, Google is proving it can cross-sell AI productivity tools to large businesses just as effectively.

Valuation Context: Unlike the deep discount seen in previous years, Google is now arguably fairly valued. The market has recognized its improved cloud margins and AI capabilities, pricing the stock efficiently. Microsoft, meanwhile, retains a higher valuation multiple, reflecting the market’s willingness to pay more for its perceived lower risk profile.

Pros and Cons Comparison Table

| Feature | Microsoft (MSFT) | Google (Alphabet – GOOGL) |

| Primary Moat | High Switching Costs (Ecosystem Lock-in) | Network Effects & Data Superiority |

| Cloud Strategy | Azure: Leader in hybrid cloud & enterprise legacy integration. | GCP: Gaining share in enterprise; leader in data analytics & AI-native workloads. |

| Valuation | Premium: Priced for stability and predictable compounding. | Fair Value: Priced appropriately for its mix of ad-stability and cloud growth. |

| AI Implementation | Copilot: Rapidly integrated into existing workflow apps (Word, Excel). | Gemini: Deeply integrated into Workspace; strong developer preference. |

| Key Risk | Execution risk on massive AI infrastructure build-out. | Regulatory antitrust pressure & search landscape evolution. |

| Investor Profile | Best for Defensive Growth (Lower Volatility). | Best for Growth at a Reasonable Price (GARP). |

Verdict: This is not a zero-sum game. Microsoft remains the “sleep well at night” stock for steady enterprise compounding. However, Google offers a compelling alternative for investors who want exposure to a company that is aggressively—and successfully—expanding its footprint in the corporate world while trading at a rational price.

Conclusion

Is Microsoft a buy? Yes, in our opinion it is. However, this is not financial advice and you should do your own due dilligence

The current sell-off is a classic case of the market’s short-term time horizon clashing with a company’s long-term strategy. Microsoft is intentionally depressing its own margins today to secure a dominant position in the next decade of computing.

For the value investor, the thesis is simple: You are buying a wide-moat business with a $625 billion backlog at a price that assumes the AI spend will fail. If you believe, as we do, that the infrastructure will eventually yield high-margin software revenue, the stock is currently on sale.

Disclaimer: This article is for educational and informational purposes only and does not constitute financial, investment, or professional advice. Always perform your own due diligence before making any financial decisions.

References

Microsoft Investor Relations: FY 2026 Q2 Earnings Press Release

Morningstar: Microsoft Stock Analysis & Fair Value