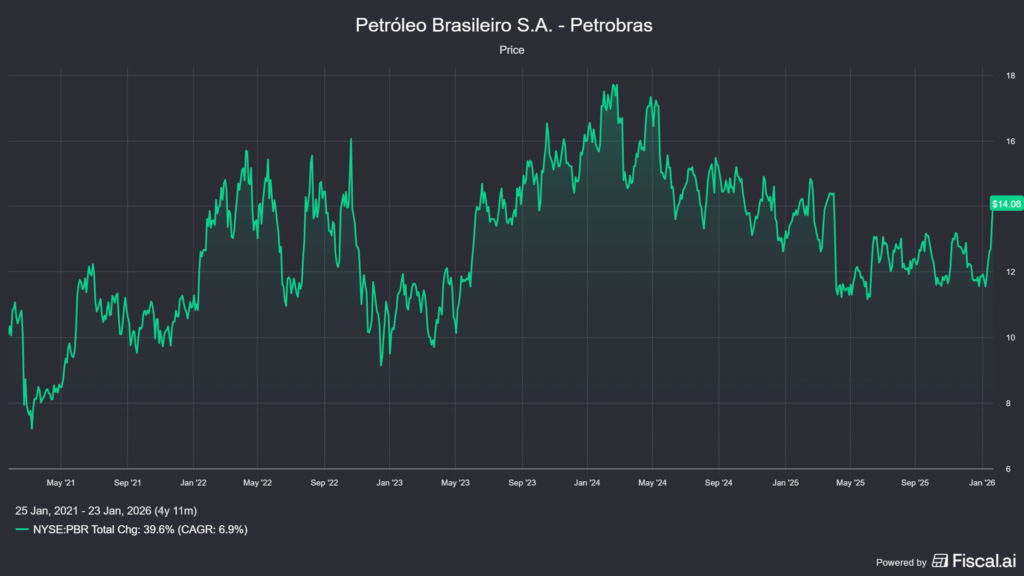

Is Petrobras A Buy? Deep Dive Into Brazil's Oil Giant

Petrobras (PBR) continues to dominate conversations among value investors seeking exposure to the energy sector. Trading at a substantial discount to Western peers like ExxonMobil and Shell, the Brazilian state-controlled oil giant presents a compelling—yet controversial—opportunity. As of January 2026, the stock sits near $14.11, offering a forward dividend yield exceeding 10% while sporting a forward P/E ratio of just 5.9x. But does this apparent bargain represent genuine value, or is it a trap masked by political risk and currency volatility?

Disclaimer: This article is for educational and informational purposes only and should not be considered financial advice. Investing in stocks carries risk, including the potential loss of principal. Always conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Petrobras Valuation Overview

| Metric | Petrobras (PBR) | Industry Average | Analysis |

|---|---|---|---|

| Current Price | $14.11 | N/A | Near 52-week high ($11.03-$14.98) |

| Forward P/E | 5.9x | ~12x | Trading at roughly 50% discount |

| Dividend Yield | 10.5%-11.5% | 3-5% | Among highest in mega-cap energy |

| PEG Ratio | 0.26 | ~1.0 | Significant undervaluation vs. growth |

| Price-to-Book | 1.05 | 1.5-2.0x | Trading near accounting value |

| Net Debt/EBITDA | ~0.8x | 1.0-1.5x | Strong balance sheet position |

| Production | 2.99M boepd | Varies | Record output; 82% from Pre-salt |

| Lifting Costs | <$6/bbl | $15-25/bbl | World-class operational efficiency |

The Bull Case: Petrobras A Cash-Generating Machine

Petrobras combines operational excellence with financial strength, creating a rare value proposition in today’s energy landscape. The company’s unique advantages—from world-class assets to industry-leading efficiency—make a compelling argument for long-term investors willing to look beyond the headlines.

1. Pre-Salt Dominance Creates Unmatched Economics

Petrobras operates some of the world’s most profitable oil fields. The Pre-salt reserves—particularly the Búzios field—deliver lifting costs below $6 per barrel, meaning the company remains highly profitable even if oil prices collapse to $35/bbl. This operational advantage translates into robust free cash flow generation that few competitors can match, especially during commodity downturns.

2. Clear Production Growth Trajectory

Unlike U.S. majors grappling with depleting Permian inventory, Petrobras has mapped out a clear path forward. The company’s 2026-2030 business plan targets peak production of 3.4 million barrels of oil equivalent per day (boepd) by 2028, with decades of reserve visibility supporting long-term expansion.

3. Double-Digit Yield Provides Downside Protection

Even after adjusting its dividend policy to retain more capital for reinvestment, Petrobras maintains its status as an emerging market dividend powerhouse. The policy of distributing 45% of free cash flow (when debt levels permit) delivers yields that create substantial margin of safety for value-oriented investors.

4. Technological Innovation Driving Efficiency

The successful deployment of “Digital Twin” technology and subsea carbon capture systems has boosted production efficiency by approximately 1% across operations. These advancements not only improve profitability but also help satisfy ESG-conscious institutional investors increasingly focused on operational sustainability.

The Bear Case: Navigating Significant Headwinds

Despite impressive fundamentals, Petrobras faces structural challenges that justify its persistent valuation discount. These risks—ranging from government interference to macro volatility—could prevent the valuation gap from ever closing, regardless of operational performance.

1. Political Risk Remains the Primary Concern

As a state-controlled enterprise, Petrobras cannot escape Brazil’s political orbit. History shows the government has repeatedly pressured the company to subsidize domestic fuel prices or pivot toward politically popular but economically questionable projects. This interference represents an ongoing threat to shareholder value that no financial metric can fully capture.

2. Capital Allocation Questions

The $109 billion capital expenditure plan for 2026-2030 raises eyebrows among investors. While necessary for growth, an increasing portion flows toward refineries and energy transition projects (wind/solar) that typically generate lower returns than the company’s core offshore drilling operations. This shift could dilute overall returns.

3. Currency Exposure Creates Volatility

Petrobras operates in a challenging currency environment—earning revenues in U.S. dollars while incurring significant costs in Brazilian reals. Substantial devaluation of the real or deterioration in Brazil’s fiscal health can quickly erode gains for ADR holders, regardless of operational performance.

4. Supply Glut Threatens Pricing Power

With production ramping up across Guyana, Argentina, and OPEC+ nations through 2026, the risk of sustained oversupply looms large. If Brent crude remains below $60 per barrel for an extended period, the valuation gap between Petrobras and its Western peers may persist indefinitely, transforming today’s “value play” into tomorrow’s value trap.

Conclusion: Is Petrobras (PBR) Value or a Value Trap?

By conventional valuation metrics—P/E, P/FCF, EV/EBITDA—Petrobras trades at a 40-50% discount to U.S. energy majors while delivering superior operational efficiency. For investors willing to accept political and currency risk, the combination of rock-bottom valuation, double-digit yields, and world-class assets presents a compelling opportunity.

However, this isn’t a simple “buy the dip” scenario. Success with Petrobras requires more than financial analysis; it demands conviction that Brazil’s government will maintain a hands-off approach and allow the company to operate as a commercial enterprise rather than a political tool. Those comfortable with emerging market volatility and patient enough to ride out macro headwinds may find Petrobras an attractive addition to a diversified energy portfolio. Conservative investors seeking stability should look elsewhere.

What Others Say About NYSE: PBR?

References

- Petrobras investor relations – (Petrobras)