Novo Nordisk Crashes 18%: Value Trap or "Mr. Market" Overreaction?

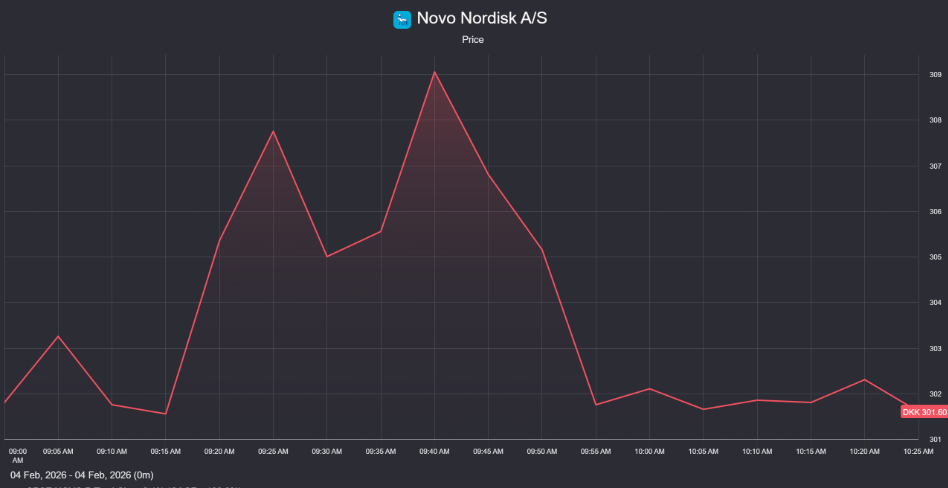

The stock market has a way of humbling even the mightiest giants. Today, Novo Nordisk (NOVO-B / NVO), the darling of the pharmaceutical world and the architect of the obesity care revolution, saw its shares plummet by over 18%.

For value investors, a sell-off of this magnitude usually rings a dinner bell. However, today’s drop is driven by a fundamental shift in the company’s narrative—from “hyper-growth” to a forecasted contraction. The release of the full-year 2025 financial report has unleashed a “perfect storm” of negative news, catching Wall Street completely off guard.

Below, we break down the earnings, the shocking 2026 guidance, and apply our value investing principles to determine if the moat is crumbling or if this is a moment of maximum pessimism.

Disclaimer: This article is for educational and informational purposes only and does not constitute financial, investment, or professional advice. Always perform your own due diligence before making any financial decisions.

The Catalyst: Why $NOVO Stock Collapsed

The primary driver of the sell-off isn’t just past performance; it is the bleak view of the future. The company issued a guidance update that effectively declared the end of its explosive growth era for the near term.

The Shocking 2026 Guidance

Wall Street hates uncertainty, but it hates negative growth even more.

The Forecast: Novo expects both sales and operating profits to decline between 5% and 13% in 2026 (at constant exchange rates).

The Expectations: Analysts had priced in a mild dip of 2-3%.

The Reality Check: This is the first projected decline in years, signaling that the “easy money” phase of the GLP-1 boom is over.

The "Perfect Storm" of Headwinds

Beyond the guidance, four other factors are squeezing the company’s valuation:

“Trump Pricing” Pressure: A new “Most Favored Nations” (MFN) agreement with the U.S. administration is forcing down realized prices for blockbuster drugs like Ozempic® and Wegovy®. The premium margins investors relied on are being legislated away.

The Patent Cliff: Exclusivity for Semaglutide is ending in key markets (China, Brazil, Canada). Meanwhile, in the U.S., 1.5 million patients have switched to cheaper “compounded” (copycat) versions, eroding official market share.

Competition is Heating Up: While Novo’s pipeline is active, competitors like Eli Lilly (Zepbound), Pfizer, and Roche are encroaching. Investors fear Novo’s new combination drug, CagriSema, may trail Zepbound in total weight loss efficacy.

Earnings Miss & Management Exit: Q4 revenue came in at DKK 74.1 billion (missing the DKK 76.9B consensus), and two top executives announced their departure. In the eyes of the market, this looks like “de-risking” from the top.

Novo Nordisk Financial Deep Dive: 2025 Performance

Before writing off the company, a value investor must look at the actual cash generation. Despite the gloomy forecast, 2025 was still a year of growth.

| Metric | Result (DKK) | Growth (CER) | Notes |

| Net Sales | 309.1 Billion | +10% | Driven by Obesity Care volume. |

| Operating Profit | 127.7 Billion | +6% | Impacted by DKK 8B in one-off transformation costs. |

| Net Profit | 102.4 Billion | +1% | Marginally up; reflects tightening margins. |

| Obesity Sales | 82.3 Billion | +31% | Wegovy® alone grew 41%. |

| Diabetes Sales | 207.1 Billion | +4% | Ozempic® grew 10%. |

The Value Investor's Lens: Moat vs. Margin of Safety

At MyInvestAcademy, we analyze whether the market has over-corrected. Here is the bull and bear case based on the new data.

NOVO Bear Case: The Moat is Leaking

The classic definition of an “economic moat” is the ability to maintain competitive advantages and pricing power.

Pricing Power Lost: The “Trump Pricing” headwinds indicate that Novo can no longer dictate terms in its most profitable market (the U.S.).

Commoditization: With “compounded” versions stealing 1.5 million customers, the unique brand value of Ozempic is diluting. It is becoming a commodity race to the bottom on price.

NOVO Bull Case: The Pivot to Oral Care

However, the market may be ignoring the pipeline potential. The “injectable” market is crowded, but Novo is pivoting to “oral” delivery—a massive convenience advantage.

The Wegovy Pill Success: Launched Jan 5, 2026, the pill hit 50,000 weekly prescriptions in its first month. This crushed expectations.

Pipeline Strength:

CagriSema: Phase 3 completed; submitted for regulatory approval.

Zenagamtide: Advanced to Phase 3 after showing significant weight loss and HbA1c reduction in Phase 2.

Restructuring for Efficiency: The company is cutting 9,000 jobs to streamline operations, which should aid margins in the long run (post-2026).

Conclusion

Today’s 18% drop is not just “noise”- it is a rational repricing of a stock that is transitioning from a high-growth momentum play to a mature pharmaceutical value play.

For the strict value investor, 2026 is a “reset year.” The forecasted earnings decline of 5-13% destroys the previous DCF (Discounted Cash Flow) models used by analysts. However, if you believe in the Wegovy Pill as the next dominant force in oral weight loss, the current sell-off may offer an entry point once the dust settles.

The “Hyper-Growth” thesis is dead. The “Turnaround & Efficiency” thesis has just begun.

Disclaimer: This article is for educational and informational purposes only and does not constitute financial, investment, or professional advice. Always perform your own due diligence before making any financial decisions.

References

- Annual report 2025 – (Novo Nordisk)